UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

The Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrantx

☒ Filed by a Party other than the Registrant¨ ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

FIRST DEFIANCE FINANCIAL CORP.

Premier Financial Corp.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| Fee paid previously with preliminary materials. |

| ☐ |

| 601 Clinton Street, Defiance, Ohio 43512 419-785-8700 | |||

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

to be held on

April 24, 2018

and

PROXY STATEMENT

TO BE HELD ON

PROXY STATEMENTAPRIL 30, 2024

601 Clinton Street

Defiance, Ohio 43512

2018 ANNUAL MEETING OF SHAREHOLDERS

April 24, 2018

GENERAL

This Proxy Statement is being furnished to shareholders of First Defiance Financial Corp. (“First Defiance,” “FDEF,”NOTICE IS HEREBY GIVEN that the “Company,” “we,” “us,” “our”). Our Board of Directors (the “Board”) is soliciting proxies to be used at our 2018 Annual Meeting of Shareholders (the “Annual(“Annual Meeting”) toof Premier Financial Corp. (“Premier”) will be held on Tuesday, April 24, 201830, 2024, at 1:0030 p.m., Eastern Time, and at any adjournment thereof, for the purposes set forth in the Notice of Annual Meeting of Shareholders.Time. The Annual Meeting will be an entirely virtual meeting. That means you can attend the Annual Meeting online, vote your shares electronically, and submit questions during the Annual Meeting by visiting www.virtualshareholdermeeting.com/fdef2018. Be surePFC2024. The Annual Meeting will be held for the following purposes, all of which are more completely set forth in the accompanying Proxy Statement:

| 1. | To elect five (5) directors; |

| 2. | To consider and approve a non-binding advisory vote on Premier’s executive compensation; |

| 3. | To consider and vote on a proposal to ratify the appointment of Crowe LLP as the independent registered public accounting firm for Premier for the year 2024; and |

| 4. | To transact such other business as may properly come before the Annual Meeting or any adjournment thereof. |

The Board of Directors of Premier has fixed March 1, 2024 as the voting record date for the determination of shareholders entitled to have your 12-Digit Control Numbernotice of and to entervote at the Annual Meeting. We began mailing and electronically distributing, as applicable, this Proxy Statement to the shareholders of First Defiance onMeeting or about March 12, 2018.

Our policy is to send a single Notice of Internet Availability of Proxy Materials to multipleat any adjournment thereof. Only those shareholders of record as of the close of business on that share the same address, unless we receive instructionsdate will be entitled to the contrary. However, each shareholder of record will continue to receive a separate proxy card. This practice, known as “householding,” is designed to reduce our printing and postage costs. If you wish to receive a separate Notice of Internet Availability of Proxy Materials, you may request it by writing to usvote at the above address. If you wish to discontinue householding entirely, you maycontact Broadridge Financial Solutions, Inc.Annual Meeting or at 1-800-542-1061 or in writing at Broadridge, Householding Department, 51 Mercedes Way, Edgewood, New York 11717. If you receive multiple copies of the Notice of Internet Availability of Proxy Materials, you may request householding by contacting Broadridge Financial Solutions as noted above. If your shares are held in street name through a bank, broker or other holder of record, you may request householding by contacting that bank, broker or other holder of record.any such adjournment.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE SHAREHOLDER MEETING TO BE HELD ON APRIL 24, 2018April 30, 2024

The Proxy Statement for the 2018 Annual Meeting of Shareholders and the 20172023 Annual Report to Shareholders, which includes the Form 10-K for the year ended December 31, 2017,2023, are both available at by (1) visiting www.proxyvote.com using, (2) calling 1-800-579-1639, or (3) sending an email to sendmaterial@proxyvote.com. If sending an email, please include your 12-Digit16-Digit Control Number andin the subject line. These materials may also be obtained upon written request to First Defianceto:

Premier Financial Corp., Danielle R. Figley,Shannon M. Kuhl, Corporate Secretary 601 Clinton

275 West Federal Street, Youngstown, Ohio 44503

| Your vote on these matters is important, regardless of the number of shares you own. In order to ensure that your shares are represented, I urge you to promptly execute and return the enclosed form of Proxy or submit your Proxy by telephone or Internet. |

BY ORDER OF THE BOARD OF DIRECTORS

Donald P. Hileman

Executive Chair

Shannon M. Kuhl

Corporate Secretary

March 15, 2024 | Defiance, Ohio 43512.

TABLE OF CONTENTS

| 601 Clinton Street, Defiance, Ohio 43512 419-785-8700 | |||

ATTENDING

PROXY STATEMENT FOR THE 2024 ANNUAL MEETING OF SHAREHOLDERS

April 30, 2024

We

This Proxy Statement is being furnished to shareholders of Premier Financial Corp. (“Premier,” “PFC,” the “Company,” “we,” “us,” or “our”). Our Board of Directors (the “Board”) is soliciting proxies to be used at our 2024 Annual Meeting of Shareholders (the “Annual Meeting”) to be held virtually on April 30, 2024, at 1:30 p.m. Eastern Time, and at any adjournment thereof, for the purposes set forth in the Notice of Annual Meeting of Shareholders.

The Proxy Statement and related materials were first made available to shareholders of Premier on or about March 18, 2024 and we expect to begin mailing these proxy materials to the shareholders of Premier on or about March 20, 2024.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDER MEETING TO BE HELD ON April 30, 2024 The Proxy Statement for the Annual Meeting of Shareholders and the 2023 Annual Report to Shareholders, which includes the Form 10-K for the year ended December 31, 2023, are both available by (1) visiting www.proxyvote.com, (2) calling 1-800-579-1639, or (3) sending an email to sendmaterial@proxyvote.com. If sending an email, please include your 16-Digit Control Number in the subject line. These materials may also be obtained upon written request to Premier Financial Corp., Shannon M. Kuhl, Corporate Secretary, 275 West Federal Street, Youngstown, Ohio 44503. | ||

ANNUAL MEETING INFORMATION

What matters will be hostingvoted on at the Annual Meeting?

The Annual Meeting will be held for the following purposes and you are being asked to vote on:

| 1. | The election of five (5) directors; |

| 2. | A non-binding advisory vote on Premier’s executive compensation to our named executive officers; |

| 3. | The ratification of the appointment of Crowe LLP as the independent registered public accounting firm for Premier for the year 2024; and |

| 4. | Any other business as may properly come before the Annual Meeting or any adjournment thereof. |

Why did you receive a Notice of Internet Availability of Proxy Materials instead of paper copies of the proxy materials?

The U.S. Securities and Exchange Commission (“SEC”) notice and access rule allows us to furnish our proxy materials over the internet to our shareholders instead of mailing paper copies of those materials to each shareholder. As a result, on or around March 20, 2024 we sent to most of our shareholders, by mail or e-mail, a notice containing instructions on how to access our proxy materials over the internet and vote online. This notice is not a proxy card and cannot be used to vote your shares. If you received only a notice this year, you will not receive paper copies of the proxy materials unless you request the materials by following the instructions on the notice or on the website referred to on the notice at no charge. You should request materials before April 16, 2024 in order to reasonably expect to receive them prior to the Annual Meeting.

We provided some of our shareholders, including shareholders who have previously asked to receive paper copies of the proxy materials, with paper copies of the proxy materials instead of a notice that the materials are electronically available over the internet.

How can you attend the Annual Meeting?

The Annual Meeting will be an entirely virtual meeting. That means you can attend the Annual Meeting live viaonline, vote your shares electronically, and submit questions during the Internet. Annual Meeting by visiting www.virtualshareholdermeeting.com/PFC2024. You do not need to attend the Annual Meeting to vote. Even if you plan to attend the Annual Meeting, please submit your vote in advance as instructed in this Proxy Statement.

A summary of the information you need to attend the Annual Meeting online is provided below:

| ● | Any shareholder can attend the Annual Meeting live via the Internet atwww.virtualshareholdermeeting.com/ |

| ● | Webcast starts at 1: |

| ● | Shareholders may vote and submit questions while attending the Annual Meeting on the Internet. |

| ● | Please have your |

| ● | Instructions on how to attend and participate via the Internet, including how to demonstrate proof of stock ownership, are posted atwww.virtualshareholdermeeting.com/ |

Questions regarding how to attend and participate via the Internet may be answered by calling 1-855-449-0991 on the day before the Annual Meeting or the day of the Annual Meeting. |

| Webcast replay of the Annual Meeting will be available until |

PROXIES

What if you have technical issues accessing the Annual Meeting or voting?

If you have technical issues accessing the Annual Meeting or if you are unable to locate your 16-digit control number, contact (855) 449-0991.

Who can vote at the Annual Meeting?

Only our shareholders of record at the close of business on March 1, 2024 (the “Voting Record Date”) are entitled to notice of, and to vote at, the Annual Meeting. On the Voting Record Date, there were 35,803,629 common shares issued and outstanding. We have no other class of equity securities outstanding that are entitled to vote at the Annual Meeting. You are entitled to cast one vote for each share owned and there is no cumulative voting with respect to the election of directors. You do not need to attend the Annual Meeting to vote and can instead follow the instructions “How to vote your shares?” below.

What constitutes a quorum for the Annual Meeting?

The presence, either in person or by proxy, of at least a majority of our outstanding shares entitled to vote, or at least 17,901,815 common shares, is necessary to constitute a quorum at the Annual Meeting. Abstentions and broker non-votes are counted in determining the presence of a quorum.

How to vote your shares?

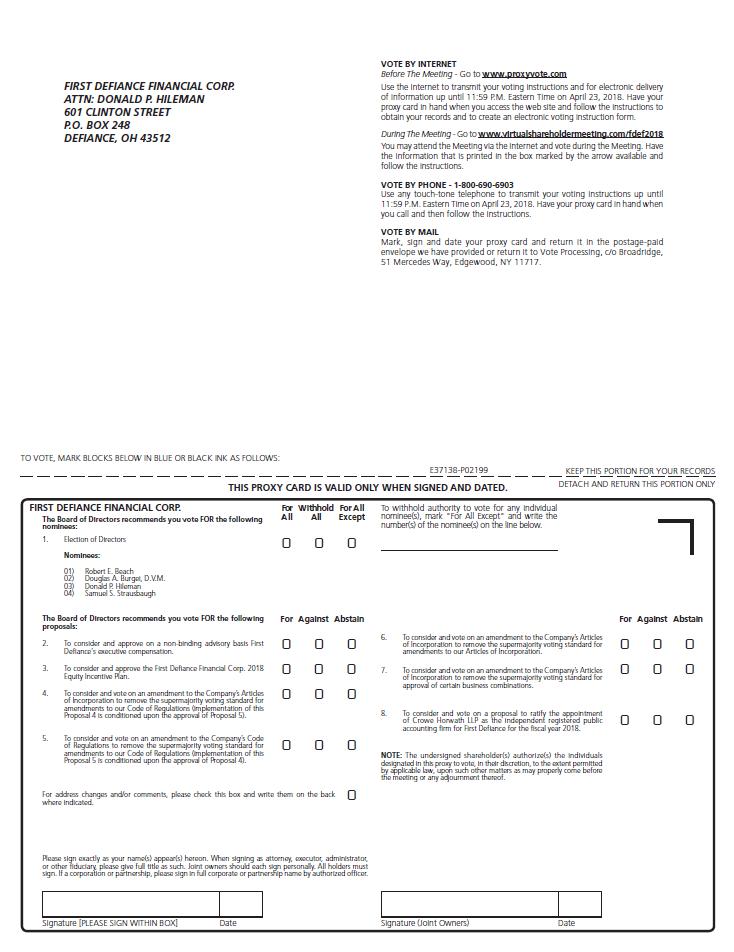

| ●Before The Meeting - Go to www.ProxyVote.com or scan the QR Barcode on your Proxy Card. Use the Internet to transmit your voting instructions and for electronic delivery of information up until 11:59 P.M. Eastern Time on April 29, 2024, unless you are voting shares held in Premier’s 401(k) Employee Savings Plan, in which case the deadline is 11:59 P.M. Eastern Time on April 26, 2024. Have your proxy card in hand when you access the web site and follow the instructions to obtain your records and to create an electronic voting instruction form. ●During The Meeting - Go to www.virtualshareholdermeeting.com/pfc2024 ● You must have the 16-digit Control Number from your Notice of Internet Accessibility to register and vote online either before or during the Annual Meeting. |

| 1-800-690-6903 - Use any touch-tone telephone to transmit your voting instructions up until 11:59 P.M. Eastern Time on April 29, 2024, or 11:59 P.M. Eastern Time on April 26, 2024 if your shares are held in the 401(k) Employee Savings Plan. Have your proxy card in hand when you call and then follow the instructions. |

| Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717 before 11:59 P.M. Eastern Time on April 29, 2024, or 11:59 P.M. Eastern Time on April 26, 2024 if your shares are held in the 401(k) Employee Savings Plan. |

If your shares are registered differently and are in more than one account, you will receive more than one proxy card. Please follow the directions for voting on each of the proxy cards you receive to ensure that all of your shares are voted.

How to vote your shares if they are held in the name of a broker?

If your shares are held by your broker, you must vote your shares through your broker. You should receive a form from your broker asking how you want to vote your shares. Follow the instructions on that form to give voting instructions to your broker.

How to vote your shares if you hold them in Premier’s 401(k) Employee Savings Plan?

If you hold PFC shares in the Premier 401(k) Employee Savings Plan, you will receive a full set of materials and your proxy card will serve as your instructions to Fidelity Management Trust Company, the trustee of the 401(k) Employee Savings Plan, to vote your shares. We must receive your completed voting instructions before 11:59 P.M. Eastern Time on April 26, 2024 in order for Fidelity Management Trust Company to vote your shares.

How will your shares be voted if you vote by proxy?

Your proxy, if properly submitted and not revoked prior to its use, will be voted in accordance with the instructions you give.Properly submitted proxies that do not contain voting instructions and that are not “broker non-votes” will be voted (1) FOR the director nominees identified in Proposal 1 herein, (2) FOR the approval of our executive compensation, (3) FOR the approval of the First Defiance Financial Corp. 2018 Equity Incentive Plan, (4) FOR the amendmentvoted:

| 1. | FOR the director nominees identified in Proposal 1 herein; |

| 2. | FOR the approval of our executive compensation; |

| 3. | FOR the ratification of the appointment of Crowe LLP (“Crowe”) as our independent registered public accounting firm for 2024; and |

| 4. | In accordance with the discretion of the persons appointed as proxies upon the transaction of such other business as may properly come before the Annual Meeting. |

How to the Company’s Articles of Incorporation to remove the supermajority voting standard for amendments to our Code of Regulations (the implementation of which is conditioned upon the approval of Proposal 5), (5) FOR the amendment to the Company’s Code of Regulations to remove the supermajority voting standard for amendments to our Code of Regulations (the implementation of which is conditioned upon the approval of Proposal 4), (6) FOR the amendment to the Company’s Articles of Incorporation to remove the supermajority voting standard for amendments to our Articles of Incorporation, (7) FOR the amendment to the Company’s Articles of Incorporation to remove the supermajority voting standard for approval of certain business combinations, (8) FOR the ratification of the appointment of Crowe Horwath LLP as our independent registered public accounting firm for 2018 and (9) in accordance with the best judgment of the persons appointed as proxies upon the transaction of such other business as may properly come before the Annual Meeting.revoke your proxy?

You may revoke your proxy at any time before it is exercised by (i)(1) filing written notice of revocation to be received prior to voting at the Annual Meeting with our Secretary, Danielle R. Figley,Shannon M. Kuhl, at 601 Clinton275 West Federal Street, Defiance,Youngstown, Ohio 43512; (ii)44503; (2) submitting a valid proxy bearing a later date that is received prior to voting at the Annual Meeting; or (iii)(3) attending the Annual Meeting online and giving notice of revocation to the Secretary.Secretary prior to voting your shares at the Annual Meeting. Attending the Annual Meeting will not, by itself, revoke a previously given proxy.

The proxies we are soliciting will only be exercised at the Annual Meeting and any adjournment thereof and will not be used for any other meeting.

VOTING RIGHTS

Only our shareholders of record at the close of business on February 23, 2018 (the “Voting Record Date”) are entitled to notice of, and to vote at, the Annual Meeting. On the Voting Record Date, there were 10,182,308 common shares issued and outstanding. We have no other class of equity securities outstanding that are entitled to vote at the Annual Meeting.

The presence, either in person or by proxy, of at least a majority of our outstanding shares entitled to voteWho is necessary to constitute a quorum at the Annual Meeting. Abstentions and broker non-votes are counted in determining the presence of a quorum.

REQUIRED VOTE

You are entitled to cast one vote for each share owned. Below are specifics regarding the vote requirement for each proposal:

For Proposal 1, the election of directors at the Annual Meeting, director nominees may be elected by a plurality of the votes cast. Our Articles of Incorporation do not permit shareholders to cumulate votes in the election of directors. Abstentions and broker non-votes will not affect the plurality vote required to elect directors.

Proposal 2 to approve our executive compensation and Proposal 8 to ratify the appointment of Crowe Horwath each require that the number of votes cast in favor of the proposal exceed the number of votes cast against it. Because abstentions will not be counted as votes cast at the Annual Meeting, they will not affect either of these proposals. Similarly, broker non-votes will not affect the proposal regarding executive compensation.

Proposal 3 to approve the First Defiance Financial Corp. 2018 Equity Incentive Plan requires that the number of votes cast in favor of this proposal exceed the number of votes cast against it. Abstentions will not be counted as votes cast at the Annual Meeting and, therefore, will not affect this proposal. Broker non-votes will also not affect this proposal.

Proposals 4, 6 and 7 to amend the Company’s Articles of Incorporation to remove the supermajority voting standards for, respectively, amendments to our Code of Regulations, amendments to our Articles of Incorporation and approval of certain business combinations must be approved by at least 75% of the votes entitled to be cast at the Annual Meeting. Abstentions and broker non-votes will be counted as votes “AGAINST” each of these proposals. In addition, Proposal 4 may only be approved if the corresponding amendment in Proposal 5 also receives shareholder approval.

Proposal 5 to amend the Company’s Code of Regulations to remove the supermajority voting standard for amendments to our Code of Regulations must be approved by at least two-thirds of the votes entitled to be cast at the Annual Meeting. Abstentions and broker non-votes will be counted as votes “AGAINST” this proposal. In addition, Proposal 5 may only be approved if the corresponding amendment in Proposal 4 also receives shareholder approval.

Because the proposals to approve our executive compensation and ratify the appointment of Crowe Horwath as our independent registered public accounting firm are advisory, they will not be binding upon the Board. However, the Compensation Committee will take into account the outcome of the executive compensation vote when considering future executive compensation arrangements. Further, if the appointment of Crowe Horwath is not ratified by the shareholders, the Audit Committee may re-consider its selection of Crowe Horwath as our independent registered public accounting firm for the fiscal year ending December 31, 2018.

Proposals 1-7 are not “discretionary” items. Ifsoliciting your shares are held in “street name,”you must provide instructions to your brokerage firm in order to cast a vote on these proposals. The ratification of the appointment of Crowe Horwath is considered a “discretionary” item, so your brokerage firm may vote in its discretion on your behalf if you do not furnish voting instructions.

proxy?

PROPOSAL 1

Election of Directors

Composition of the Board

Currently, the Board consists of 13 directors and is divided into three classes, with two of the classes having four members and one class having five members. The directors are elected by class to serve a three-year term. The terms of the three classes expire at successive annual meetings so that the shareholders elect one class of directors at each annual meeting.

Effective as of January 4, 2018, Ms. Bettinger, Mr. Herman and Mr. Robison were appointed to the First Defiance Board of Directors by a unanimous vote of the Board to fill the vacancies created by the retirement of Stephen L. Boomer on December 31, 2017 and an increase in the size of the Board to 13 directors. The Board appointed Ms. Bettinger and Mr. Herman to fill the vacancies in the class of directors with a term expiring at the 2019 annual meeting and Mr. Robison to fill a vacancy in the class of directors with a term expiring at the 2020 annual meeting.

We will elect four directors at the Annual Meeting. The director nominees standing for election at the Annual Meeting are Mr. Beach, Mr. Burgei, Mr. Hileman and Mr. Strausbaugh. Those nominees elected to the Board at the Annual Meeting will serve until our annual meeting in 2021, and until each such person’s successor is duly elected and qualified. If any of the four nominees should become unable or unwilling to stand for election at the Annual Meeting, the persons named on the proxy card as proxies may vote for other person(s) selected by the Board. We have no reason to believe that any of the director nominees for election named in this Proposal 1 will be unable or unwilling to serve. Each director nominee has consented to act as a director if elected.

The Board has determined that each of Terri A. Bettinger, John L. Bookmyer, Douglas A. Burgei, Thomas K. Herman, Jean A. Hubbard, Barbara A. Mitzel, Charles D. Niehaus, Thomas A. Reineke, Mark A. Robison and Samuel S. Strausbaugh is “independent” under the rules of The NASDAQ Stock Market LLC (“NASDAQ”). In assessing the independence of directors and the director nominees, the Board considered the business relationships between First Defiance and its directors or their affiliated businesses, other than ordinary banking relationships. Where business relationships other than ordinary banking relationships existed, including those disclosed under “Related Person Transactions” below, the Board determined that none of the relationships between First Defiance and their affiliated businesses impaired the directors’ or director nominees’ independence because the amounts involved were immaterial to the directors or to those businesses when compared to their annual income or gross revenues. Although William J. Small and Robert E. Beach are each “independent” under the rules of NASDAQ, the Board has determined Mr. Beach is not “independent” due to his prior position as President and CEO of Commercial Bancshares, Inc., which was acquired by the Company on February 24, 2017, and Mr. Small is not “independent” due to his prior position with the Company and First Federal.

Nominees for Election at this Annual Meeting:

Board Leadership Structure

Since his appointment as President and CEO in 1999, William J. Small has served as Chairman of the Board of Directors. Upon Mr. Small’s retirement in 2013, he retained the position of Chairman and Donald P. Hileman became our President and CEO. This marked the first time in over a decade that these positions had been split. The Board decided it was time to divide these roles because, by doing so, they could continue to benefit from Mr. Small’s experience in a leadership role, and his in-depth familiarity with our hiring and operations.

The Board is aware that one of its responsibilities is to oversee our management and make performance, risk and compensation-related decisions regarding management. In order to appropriately balance the Board’s focus on strategic development with its management oversight responsibilities, the Board created the position of Lead Independent Director. On January 4, 2018, John L. Bookmyer was appointed by the Board as Lead Independent Director following Stephen L. Boomer’s retirement from this position on December 31, 2017. As Lead Independent Director, Mr. Bookmyer is a permanent member of the Board’s Executive Committee and presides over executive sessions of the Board, which are attended only by non-management directors. In addition, Mr. Bookmyer is an active liaison between management and our non-management directors and with individual non-management directors concerning recent developments affecting us. Through the role of an active, engaged Lead Independent Director, the Board believes that its leadership structure is appropriately balanced between promoting our strategic development with the Board’s management oversight function. The Board also believes that its leadership structure has created an environment of open, efficient communication between the Board and management, enabling the Board to maintain an active, informed role in risk management by being able to monitor and oversee those matters that may present significant risks to us. The Board intends to maintain the Lead Independent Director position until such time as Mr. Small would qualify as an independent director or an Independent Chairman is appointed.

Board Committees

The Board has five standing committees: Audit, Corporate Governance, Compensation, Executive and Risk. The current members of our standing committees are named below:

# - Chairperson

## Vice Chairperson

** - Lead Independent Director

*** -Denotes Rotating Service

TheAudit Committee is responsible for: (i) the appointment of our independent registered public accounting firm; (ii) review of the external audit plan and the results of the auditing engagement; (iii) review of the internal audit plan and results of the internal audits; (iv) review of reports issued by our Compliance Officer; (v) review of the effectiveness of our system of internal control, including review ofthe process used by management to evaluate the effectiveness of the system of internal control; and (vi) oversight of our accounting and financial reporting practices. The Audit Committee has adopted a written charter setting forth these responsibilities, a copy of which is posted on our website athttp://www.fdef.com under the link “Governance Documents.” The Board has determined that John L. Bookmyer and Samuel S. Strausbaugh each have the attributes listed in the definition of “audit committee financial expert” set forth in Item 407(d)(5)(ii) of Regulation S-K and in the NASDAQ listing requirements. All of the Audit Committee members are considered “independent” for purposes of NASDAQ listing requirements and meet the NASDAQ standards for financial sophistication. The Audit Committee met five times in 2017.

TheGovernance and Nominating Committeewas established by the Board to ensure that the Board is appropriately constituted and conducts its affairs in a manner that will best serve the Company’s interests and those of our shareholders. Specific duties of the Committee include administering our conflict of interest policy/code of ethics, monitoring the Board’s continuing education and self-assessment process, nominating directors to the Board, and conducting an annual assessment of the Board as a whole, including an assessment of Board composition and committee assignments. The Governance and Nominating Committee develops, with management, the materials discussed and presented at the board strategic planning meeting. The Governance and Nominating Committee maintains a robust process for succession planning for the CEO as well as for other executive-level positions. The Governance and Nominating Committee maintains both an emergency plan and a long-range succession plan. The plans are reviewed at least annually by the Governance Committee. The Governance and Nominating Committee has adopted a written charter setting forth its responsibilities, a copy of which is posted on our website athttp://www.fdef.com under the link “Governance Documents.” The Governance and Nominating Committee met four times in 2017.

The Governance and Nominating Committee believes that candidates for director should have certain minimum qualifications, including being able to read and understand basic financial statements, having business experience, and exhibiting high moral character. Although the Committee does not have a formal diversity policy in place, the Committee seeks to promote a diverse set of viewpoints and business experience in the Board’s membership. The Committee retains the right to modify these minimum qualifications from time to time as circumstances dictate. The Committee has a general process for choosing nominees, which process considers both incumbent directors and new candidates. In evaluating an incumbent director whose term of office is set to expire, the Committee reviews such director’s overall service to us during his or her term, including attendance at meetings, participation and quality of performance. If the Committee chooses to evaluate new director candidates, the Committee uses its network of contacts to compile a list of potential candidates. Then, the Committee determines whether such candidates are independent, which determination is based upon applicable securities laws. Finally, the Committee meets to discuss and consider all candidates’ qualifications and then chooses those candidates who will be proposed as director nominees to the full Board. The Governance and Nominating Committee considers the following criteria in proposing director nominees to the full Board: (1) independence; (2) high personal and professional ethics and integrity; (3) ability to devote sufficient time to fulfilling duties as a director; (4) impact on diversity of the Board, including skills and other factors relevant to our business; and (5) overall experience in business, education, and other factors relevant to our business.

Our shareholders may also make nominations for candidates for director to the Governance and Nominating Committee, provided that notice of such nomination is given in writing to our Secretary not less than 60 days prior to the anniversary date of the immediately preceding annual meeting of shareholders. The notice must set forth the name, age, business address and residence address (if available) of the nominee and the number of shares that are beneficially owned by the nominee. Also, the shareholder making the nomination must promptly provide any other information reasonably requested by the Governance and Nominating Committee. This Committee does not alter the manner in which it evaluates candidates, including the minimum criteria set forth above, when evaluating a candidate who was recommended by a shareholder. No director nominations were received from shareholders for the election of directors at the Annual Meeting.

TheCompensation Committee is responsible for overseeing our compensation programs, including base salaries, long-term incentive compensation, equity-based compensation, perquisites and benefit plans. The Committee also administers the process for evaluating our Chief Executive Officer and recommends to the Board the compensation for directors (including committee member and committee chair’s fees, equity-based awards and other similar items, as appropriate). The Committee uses the services of an independent executive compensation consulting firm, Pay Governance, to fulfill its responsibilities for evaluating and establishing the compensation program for the Company’s executive officers. In 2017, the Committee engaged Pay Governance to review and analyze our executive compensation program, including salaries for our directors, CEO, CFO, Chief Risk Officer and Community Banking President/Chief Lending Officer of First Federal, to provide a study of comparative compensation data derived from the Company’s peer group and to advise the Committee on developing governance trends among such peer group. Pay Governance reports directly to the Compensation Committee and serves at the discretion of the Committee, although the CEO has consulted directly with Pay Governance regarding the compensation of executives among our peer group in recommending 2017 salaries for our remaining executive officers. The Committee has the sole authority to appoint, compensate and oversee Pay Governance, including responsibility for evaluating Pay Governance’s independence and establishing its fees and retention terms. In retaining Pay Governance for fiscal year 2017, the Committee assessed Pay Governance’s independence pursuant to the applicable rules of the Securities and Exchange Commission and determined that Pay Governance’s services for the Compensation Committee did not raise any conflict of interest. In addition, Pay Governance did not provide any additional services to the Company other than the services to the Compensation Committee in fiscal year 2017. Further description of the Compensation Committee’s responsibilities and the role of Pay Governance in determining executive compensation is set forth under “Compensation Discussion and Analysis” below. The Compensation Committee has adopted a written charter setting forth its responsibilities, a copy of which is posted athttp://www.fdef.com under the link “Governance Documents.” All of the Compensation Committee members are considered “independent” for purposes of NASDAQ listing requirements. The Compensation Committee met three times in 2017.

TheExecutive Committee generally has the power and authority to act on behalf of the Board between scheduled meetings unless specific Board action is required or unless otherwise restricted by our Articles of Incorporation or Code of Regulations or by action of the Board. As Chairman of the Board, Mr. Small serves as Chairman of the Executive Committee. Mr. Small, Mr. Bookmyer and Mr. Hileman serve as permanent members. The remaining directors serve on the Executive Committee on a rotating basis during the year. The Executive Committee did not meet during 2017.

TheRisk Committeewas established by the Board of Directors to assist the Board in fulfilling its oversight responsibilities with regard to the risk appetite of the Company and the risk management and compliance framework and the governance structure that support the Company. The Risk Committee has adopted a written charter setting forth these responsibilities, a copy of which is posted on the Company’s website athttp://www.fdef.com under the link “Governance Documents.” The Risk Committee met four times during 2017.

Compensation Committee Interlocks and Insider Participation

Mr. Bookmyer, Ms. Hubbard, Mr. Boomer and Mr. Strausbaugh served on the Compensation Committee during 2017. There were no Compensation Committee interlocks or insider (employee) participation during 2017.

Board and Board Committee Meetings

Our Board holds regular meetings each quarter. First Federal’s Board of Directors meets twice each quarter. Special meetings of the Boards are held from time to time as needed. There were five meetings of the Board of Directors of First Defiance and eight meetings of the Board of Directors of First Federal held during 2017.All of our directors attended at least 75% of the total number of meetings of the Board of Directors of First Defiance or First Federal, as applicable, and meetings held by all committees of the Board on which the director served during 2017.

Neither the Board nor the Corporate Governance Committee has implemented a formal policy regarding director attendance at our annual shareholder meetings. In 2017, all eleven of our then incumbent directors attended the annual meeting.

Non-management directors met two times in executive session in 2017.

Director Compensation

The table below provides information concerning our director compensation for the fiscal year ended December 31, 2017. Employee directors are not paid for Board service. Each non-employee director received an annual retainer of $31,000 in 2017, except that the non-employee Chairman received a retainer of $56,000 and the Lead Independent Director received a retainer of $34,000. The Company pays directors $10,000 of the annual retainer in First Defiance stock and the remainder in cash. The Company uses a 20 day average stock price when calculating the number of shares to be issued. Committee chairs received an additional annual retainer as follows: (1) Audit Committee – $5,000; (2) Compensation Committee – $5,000; (3) Risk Committee – $5,000; and (4) Corporate Governance Committee – $3,500. In addition, each non-employee director received $750 for each board meeting attended for either First Defiance or First Federal. Mr. Small and Mr. Burgei are also directors of First Insurance Group of the Midwest, Inc., and they received $500 for each First Insurance board meeting attended. Non-employee directors also received compensation for each committee meeting attended as follows: (1) Audit Committee – $500; (2) Compensation Committee – $500; (3) Executive or First Federal Executive Loan Committee meetings – $200; and (4) other First Defiance and First Federal Board committees – $500.

Our directors may defer their retainer and/or meeting fees payable to them under the First Defiance Deferred Compensation Plan. The returns on the amounts deferred are dependent on the investment elections made by the director. The directors’ choices include a number of mutual funds and an account of our common shares. Returns under the plan are calculated to mirror these elections. Because these earnings are denominated in our shares or mutual fund equivalents, such earnings are not considered to be preferential or above market and are not reported in the table below. Also, no director received perquisites or personal benefits with an aggregate value exceeding $10,000.

The Board has set ownership guidelines for the Board and executive management. The guideline for each Board member is ownership equal to a value of 5 times the annual retainer of $31,000 in shares of First Defiance. The Company allows for the payment of directors fees in either cash or stock at the election of the individual director.

2017 Director Compensation

| Director | Fees Earned or Paid in Cash ($)(a) | Stock Awards ($)(b) | Total ($) | |||||||||

| Bookmyer, John L. | $ | 41,750 | $ | 10,239 | $ | 51,989 | ||||||

| Boomer, Stephen L. | $ | 50,450 | $ | 10,239 | $ | 60,689 | ||||||

| Burgei, Douglas A. | $ | 35,400 | $ | 10,239 | $ | 45,639 | ||||||

| Hubbard, Jean A. | $ | 43,650 | $ | 10,239 | $ | 53,889 | ||||||

| Mitzel, Barbara A. | $ | 37,250 | $ | 10,239 | $ | 47,489 | ||||||

| Strausbaugh, Samuel S. | $ | 43,750 | $ | 10,239 | $ | 53,989 | ||||||

| Niehaus, Charles D. | $ | 38,250 | $ | 10,239 | $ | 48,489 | ||||||

| Small, William J. | $ | 63,950 | $ | 10,239 | $ | 74,189 | ||||||

| Reineke, Thomas A. | $ | 36,250 | $ | 10,239 | $ | 46,489 | ||||||

| Beach, Robert E. | $ | 32,400 | $ | 8,532 | $ | 40,932 | ||||||

Communication with Directors

The Board has adopted a process by which shareholders may communicate with the directors. Any shareholder wishing to do so may write to the Board at our principal business address – 601 Clinton St., Defiance, Ohio 43512. Any shareholder communication so addressed will be delivered unopened to the director or a member of the group of directors to whom it is addressed, or to the Chairman if addressed to the Board.

Corporate Governance Guidelines

The Board has adopted Corporate Governance Guidelines as a framework to assist the Board in exercising its responsibilities. These Guidelines address expectations of the Board in performing its duties and reflect its ongoing efforts to enhance its effectiveness and corporate governance. These Guidelines will be periodically reviewed and modified as deemed appropriate by the Board. The Guidelines can be found on the Company’s website athttp://www.fdef.comunder the link “Governance Documents.”

Board’s Role in Strategic Planning

Our Board has the legal responsibility for overseeing our affairs and, thus, an obligation to keep informed about our business and strategies. This involvement enables the Board to provide guidance to management in formulating and developing plans and to exercise independently its decision-making authority on matters of importance to us. Acting as a full Board and through its standing committees, the Board is fully involved in our strategic planning process.

Each year, typically in September, senior management and the Board hold an extended meeting to focus on corporate strategy. This session involves presentations from management and input from the directors regarding the assumptions, priorities and strategies that will form the basis for management’s operating plan and strategy for the coming year. At subsequent meetings, the Board continues to review our progress against the strategic plan and to exercise oversight and decision-making authority regarding strategic areas of importance and revise the strategic plan as necessary. The role the Board plays is inextricably linked to the development and review of our strategic plan. Through these procedures, the Board, consistent with good corporate governance practices, encourages our long-term success by exercising sound and independent business judgment on the strategic issues that are important to our business.

Board’s Role in Risk Oversight

The Board’s function of overseeing risk is handled primarily by the Risk Committee. The Chief Risk Officer works with management as well as internal and external auditors to determine and evaluate significant risks that we may be taking and communicates those findings directly to the Risk Committee. The Risk Committee is focused on identifying, quantifying, and minimizing our risks. The Risk Committee believes that by involving both management and auditors in this important process, it is best able to perform its function. First Federal also has a standing Officer Risk Management Committee, Compliance Committee, Information Technology Steering Committee and Asset Review Committee that meet regularly to provide structure and input into our Risk Management Process. The minutes and findings of these committees are presented to the Risk Committee.

EXECUTIVE OFFICERS

The following table sets forth the name of each current executive officer, other than Mr. Hileman, whose information is set forth above, and the principal position and offices he or she holds with First Defiance or First Federal.

| ||

|

COMPENSATION DISCUSSION AND ANALYSIS

The following Compensation Discussion and Analysis describes the material elements of compensation of our executive officers identified in the Summary Compensation Table (“Named Executive Officers”). Our goal is to become a high performing community bank, meeting or exceeding the 75th percentile of our peers in key financial measures.

In 2017, we reported our fifth consecutive year of record diluted earnings per common share and completed two strategic acquisitions. The acquisition of Commercial Bancshares, Inc. added approximately $350 million in assets, expanded our footprint, and provided enhanced efficiency opportunities. The acquisition of Corporate One Benefits Agency, Inc. enhanced our employee benefit offerings and expanded our insurance presence into adjacent markets. Diluted earnings per share for 2017 were $3.22, up only 1% from 2016 primarily due to the impact of acquisition and merger related expenses, which reduced earnings by $0.28 per diluted share. Even with the acquisition and merger related costs, we posted a strong return on average assets at 1.13% and improved efficiency ratio to 61.81%. Growth in loans and deposits was 21% and 23%, respectively, including the acquisitions, and 6.4% and 7.5%, respectively, excluding the acquisitions.

For the three year period ending December 31, 2017, our three year cumulative growth in earnings per share was 32%, even with the impact of acquisition and merger related costs in 2017. This performance was mainly due to a strong three year average return on assets of 1.17%. Over this same period, First Defiance shares posted a total return to shareholders of 62.5%.

Compensation Philosophy and Objectives

The Board believes the most effective executive compensation program is one that rewards the achievement of specific annual, long-term and strategic goals that are established in conjunction with strategic planning initiatives and the long-term objective of maximizing shareholder value. Consistent with that philosophy, our executive compensation packages include both cash and stock-based compensation that reward performance as measured against predetermined goals. The Compensation Committee (the “Committee”) evaluates our executive compensation to ensure that it is sufficiently competitive to enable us to attract and retain qualified employees in key positions. Total compensation commensurate with the median compensation paid to similarly situated executives of peer companies is generally what the Committee considers competitive.

The Board encourages ownership of FDEF shares by its executive management, which is why a significant part of each Named Executive Officer’s compensation package is paid in equity. As a result, the Committee has established share ownership guidelines for executives as follows:

Advisory Vote on Executive Compensation

At the 2013 annual meeting, our shareholders approved holding annual votes on our executive compensation. In addition, the Board receives investor feedback through the Company’s participation at investor conferences periodically throughout the year. In 2017, executive management participated in the KBW Community Bank Investor Conference in New York, New York; the Raymond James U.S. Bank Conference in Chicago, Illinois; and the Hovde Group Fast Forward Bank Conference in Scottsdale, Arizona, with no concerns on executive compensation raised by investors. At our 2017 annual meeting, our shareholders approved our executive compensation with 96.1% of the votes cast, indicating that shareholders are strongly supportive of our executive compensation program. The resolution to approve First Defiance’s executive compensation is advisory, so it is not binding upon the Board of Directors. However, the Committee took the shareholder vote into account when reviewing executive compensation for 2017 and will continue to monitor shareholder approval levels going forward.

CEO Pay Ratio

Beginning with the proxy statement for the Annual Meeting and for each annual meeting thereafter, we are required to disclose the median of the total compensation of the Company’s employees, excluding the Company’s CEO, for the last completed fiscal year, the annual total compensation of the Company’s CEO for the last completed fiscal year and the ratio between the foregoing compensation amounts. We identified the median employee by examining the 2017 total federal taxable compensation through December 1, 2017 for all individuals, excluding our CEO, who were employed by us on November 27, 2017 (whether employed on a full-time, part-time, or seasonal basis). For such employees, we did not make any assumptions, adjustments, or estimates with respect to total federal taxable compensation, and we did not annualize the compensation for any full-time employees that were not employed by us for all of 2017. After identifying the median employee, we calculated annual total compensation for such employee using the same methodology we use for our Named Executive Officers as set forth in the Summary Compensation Table on page 30 of this Proxy Statement.

For fiscal year 2017, the annual total compensation of our CEO was $981,605 and the annual total compensation for the median employee was $39,897, resulting in a ratio of 24.6:1.0.

Roles of the Committee and Chief Executive Officer in Compensation Decisions

The Committee makes all compensation decisions for the Company’s executive officers. The CEO makes compensation recommendations to the Committee for all Named Executive Officers except himself.

2017 Executive Compensation Components

For the fiscal year ended December 31, 2017, the principal components of compensation for our Named Executive Officers were:

In the latter part of 2016, the Committee engaged Pay Governance to perform an analysis of compensation for our directors, CEO, CFO, Chief Risk Officer and Community Banking President/Chief Lending Officer of First Federal. In conducting this analysis, Pay Governance independently developed competitive data for base salaries, short-term incentives, total cash compensation (sum of salary and bonus), long-term incentives, equity compensation and total direct compensation (sum of cash compensation and long-term incentives) from: (1) proxies and SEC filings of select peer banks ranging in asset size from $1.3 billion to $5.4 billion, with a median asset size of $2.9 billion compared to $2.8 billion proforma for First Defiance, with its pending acquisition of Commercial Bancshares, Inc., (2) surveys of other banks and (3) the consulting experience of Pay Governance.

For 2017, the Committee determined to use the peer group recommended by Pay Governance to evaluate the appropriateness of the compensation package for each of First Defiance and First Federal’s officers, including the Named Executive Officers, and to evaluate the relative performance measures for the long-term incentive compensation payable under the First Defiance Financial Corp. and Affiliates Incentive Compensation Plan (the “Incentive Compensation Plan”). That peer group is:

Compared to the 2016 peer group, Canandaiga National Corp., HopFed Bancorp, Inc., LCNB Corp., and S&T Bancorp Inc. were removed and City Holding Co., Financial Institutions Inc., MBT Financial Corp, Mercantile Bank Corporation, MVB Financial Corp., Republic Bancorp, Inc., 1st Source Corporation, First Financial Corporation, and United Community Financial Corp. were added as a result of the criteria for peers outlined above.

Base Salary

We provide our Named Executive Officers and other employees with a base salary to compensate them for services rendered during the fiscal year. The base salary for each of the Named Executive Officers is generally determined at the beginning of the year.

Based upon Pay Governance’s 2014 analysis of peer group compensation practices and resulting recommendations, the Committee determined in 2015 to gradually increase Mr. Hileman’s compensation over a three-year transition period to the market median salary level among First Defiance’s peer companies. In 2017, the Committee considered Pay Governance’s recommendation, the CEO’s performance review, the 2016 performance of the Company and the Pay Governance salary comparison data for CEOs in our peer group in deciding to increase Mr. Hileman’s salary from $430,000 to $450,000 for 2017.

Base salaries for Named Executive Officers other than the CEO are determined based upon recommendations made by the CEO. In making a recommendation for 2017 salaries, the CEO compared the base salary levels of the other Named Executive Officers with data from the ABA Compensation & Benefits Survey, the OBL Bank Compensation and Benefits Survey, the Crowe Horwath LLP Compensation Survey and internal pay grades, and consulted with Pay Governance regarding the median levels of the peer group above. As a result of Mr. Hileman’s review of this benchmarking compensation data, Mr. Hileman recommended salary increases for 2017 ranging from 2.6% to 4% for Mr. Thompson, Mr. Reisner, Mr. Allen and Mr. Rose. After evaluating a number of factors, including performance evaluations, the Committee decided to approve all of Mr. Hileman’s recommendations.

Performance-Based Incentive Compensation

The Board believes that a significant amount of executive officer compensation should be performance-based. Under the Incentive Compensation Plan, we have created opportunities for employees to earn short-term and long-term incentive compensation in the form of both cash and equity awards based on the level of achievement of performance targets that are established each year by the Committee. The Board believes this incentive compensation aligns with shareholder interests, enables attraction and retention of executive talent, balances risk with rewards and supports the long-term performance goals of the Company. In general, the Committee establishes threshold, target and maximum bonus payout goals. If the threshold performance level is not achieved, the payout percentage for that component of the bonus calculation is zero. If the performance level for a component is between the threshold and target or between the target and the maximum performance goal, the payout percentage is prorated.

In 2016, the Committee, with consultation from Pay Governance, established incentive targets and granted awards for 2017 under the Incentive Compensation Plan to permit employees who are selected as participants to earn a specified “target” percentage of their base salary, which is split between a short-term award paid in cash and based on the Company’s 2017 performance, and a long-term award paid in equity and based on the Company’s performance from 2017 to 2019. Both the short-term award and the long-term award can be earned at between 0% and 150% of the specified “target” depending on the level of attainment of the performance objectives. Specific payout amounts for these incentive-based awards are discussed below.

2017 Short-Term Executive Incentive Compensation.As authorized under the Incentive Compensation Plan, the Company may grant short-term incentive compensation to key officers, including the Named Executive Officers. At the end of the performance period, these short-term incentive compensation awards are payable in cash based upon the level of achievement with respect to the specified annual performance goals. The goals for each Named Executive Officer are established in conjunction with the Board’s and management’s expectations for the year and weighted for each officer based on the officer’s role within the Company.

For 2017, the performance goals for the short-term incentive compensation award for the Named Executive Officers anticipated the Company’s completion of the acquisition of Commercial Bancshares, Inc. in February 2017 and included three common goals: Earnings Per Share, Efficiency Ratio, and Deposit Growth. The Board believes that Earnings Per Share measures the Company’s profitability consistent with shareholder interests, Efficiency accentuates controlling expenses, and Deposit Growth reflects the organic expansion of our business.

The related payout percentages of the bonus potential for the common goals are described below:

| Award Formula Component | Threshold (50% Payout) | Target (100% Payout) | Maximum (150% Payout) | Actual attained level | Payout percentage | |||||||||||||||

| Earnings Per Share (1) | $ | 3.16 | $ | 3.23 | $ | 3.46 | $ | 3.20 | 90.00 | % | ||||||||||

| Efficiency Ratio (2) | 63.69 | % | 61.50 | % | 59.31 | % | 62.00 | % | 88.41 | % | ||||||||||

| Deposit Growth (3) | 2.46 | % | 4.73 | % | 7.00 | % | 7.45 | % | 150.00 | % | ||||||||||

In addition, for 2017, the performance goals for Mr. Reisner and Mr. Allen included an individual performance goal component based on their respective roles and responsibilities in the Company. The criteria for Mr. Reisner’s performance were focused on the performance of the Risk Management Group and for Mr. Allen the criteria focused on the performance of the Community Banking Group. The performance goals for Mr. Rose were aligned consistent with the 2017 objectives for his role as Director of Strategy Management.

The relative weighting of the goals for each Named Executive Officer is described below:

| Award Formula Component | Donald P. Hileman | Kevin T. Thompson | John R. Reisner | Gregory A. Allen | Dennis E. Rose | |||||||||||||||

| Individual Goal Component Weighting | ||||||||||||||||||||

| Earnings Per Share | 33.33 | % | 33.33 | % | 16.66 | % | 20.00 | % | 25.00 | % | ||||||||||

| Efficiency Ratio | 33.33 | % | 33.33 | % | 16.66 | % | 20.00 | % | 25.00 | % | ||||||||||

| Deposit Growth | 33.33 | % | 33.33 | % | 16.66 | % | 30.00 | % | 50.00 | % | ||||||||||

| Individual Assigned Goals | 0.00 | % | 0.00 | % | 50.00 | % | 30.00 | % | 0.00 | % | ||||||||||

| Total | 100.00 | % | 100.00 | % | 100.00 | % | 100.00 | % | 100.00 | % | ||||||||||

In 2017, the Named Executive Officers exceeded the Threshold level of performance in all award components. The Committee reviewed the components and earned payouts and certified the cash payouts at the earned level for the short-term incentive compensation. The short-term incentive payouts for the Named Executive Officers ranged between 28% and 50% of base salary.

The 2017 target short-term incentive compensation component and actual bonus payout as approved by the Committee for the Named Executive Officers are set forth below:

| Award Potential at Target | ||||||||||||

| Executive Officer | (% of Base Salary) | Target | Actual Payout | |||||||||

| Donald P. Hileman | 45 | % | $ | 202,500 | $ | 221,657 | ||||||

| Kevin T. Thompson | 35 | % | $ | 81,080 | $ | 88,751 | ||||||

| Gregory R. Allen | 35 | % | $ | 74,443 | $ | 60,061 | ||||||

| John R. Reisner | 35 | % | $ | 68,196 | $ | 79,169 | ||||||

| Dennis E. Rose | 25 | % | $ | 41,997 | $ | 50,228 | ||||||

2017 Long-Term Executive Incentive Compensation.In addition to the short-term incentive compensation awards, the Committee may also grant long-term incentive compensation awards under the Incentive Compensation Plan. These long-term awards are intended to reward certain executives, including the Named Executive Officers, for increasing the value of the Company through sustained future growth and profitability. Awards are made in restricted stock units (“RSUs”) issued under our 2010 Equity Incentive Plan at the beginning of a three-year performance period. At the end of such three-year performance period, First Defiance’s performance is evaluated and each whole or fractional RSU entitles the officer to receive one FDEF share on the date the RSU is settled. In the first quarter of 2017, the Committee established long-term incentive compensation awards for certain executives, including the Named Executive Officers, with a three-year performance period. With respect to these awards, we entered into a 2017 Long-Term Restricted Stock Unit Award Agreement with each of the Named Executive Officers, pursuant to which, each officer was awarded an amount of RSUs equal to 100% of the Maximum payout under the long-term incentive compensation component of the Incentive Compensation Plan. The number of RSUs granted under the Plan was calculated by taking the maximum incentive payout dollar value divided by the 20-day average share closing price as of December 31, 2016. Under the 2017 Long-Term Restricted Stock Unit Award Agreements, if the officer’s employment terminates for any reason (except for certain circumstances as described in the Award Agreement that has special vesting schedules for death, disability, retirement and change in control) prior to the end of the applicable performance period, the officer forfeits all of the RSUs subject to the target award for that and any subsequent performance period.

The 2017-2019 long-term incentive compensation award target for each of the Named Executive Officers is set forth below:

| Bonus Potential Dollar Amount(1) | ||||||||||||

| Executive Officer | (% of Base Salary) | Target | Maximum | |||||||||

| Donald P. Hileman | 45 | % | $ | 204,648 | $ | 310,072 | ||||||

| Kevin T. Thompson | 35 | % | $ | 81,946 | $ | 124,161 | ||||||

| Gregory R. Allen | 35 | % | $ | 75,248 | $ | 114,013 | ||||||

| John R. Reisner | 35 | % | $ | 68,919 | $ | 104,423 | ||||||

| Dennis E. Rose | 25 | % | $ | 42,463 | $ | 64,338 | ||||||

The long-term incentive compensation awards granted in 2017 have the same payout percentages and components as the long-term incentive compensation awards granted in 2016, and utilize the same peer group established by the Committee as set forth above under the heading “2017 Executive Compensation Components” above. The applicable performance criteria and weighting for the 2017-2019 performance period are as described below:

Achievement of the performance levels are determined by the Committee, in its sole discretion, using financial information filed with the Securities and Exchange Commission and other sources as available. The Committee reserves the right, in its sole discretion, to make such periodic adjustments as it determines appropriate to the peer group.

For the 2015 long-term incentive compensation awards with a performance period ending on December 31, 2017, the relative weighting of each target and the related payout percentage of the bonus potential are described below:

| Award Formula Component | Threshold (33% Payout) | Target (66% Payout) | Maximum (100% Payout) | Actual attained level | Payout percentage | |||||||||||||||

| Return on Assets 2015-2017 three-year average (50% weighting) | 0.89 | % | 0.92 | % | 1.08 | % | 1.17 | % | 100.00 | % | ||||||||||

| EPS Growth for three years 2015 - 2017 (50% weighting) | 7 | % | 20 | % | 42 | % | 32 | % | 84.55 | % | ||||||||||

| 2015 - 2017 long-term incentive total weighted payout percentage | 92.27 | % | ||||||||||||||||||

In 2015, the Committee established an additional performance goal or “kicker” goal applicable to the long-term incentive compensation awards based upon the achievement of growth in total assets, consistent with the Company’s strategic growth objectives. Upon the achievement of this additional goal, the Committee may grant, within its sole discretion, to each Named Executive Officer an additional payout of from 10% to 25% of the target bonus potential under the long-term incentive compensation awards as set forth below:

| Bonus Potential Dollar Amount | ||||||||||||||||

| Executive Officer | % of Target Bonus | Threshold | % of Target Bonus | Maximum | ||||||||||||

| Donald P. Hileman | 10 | % | $ | 20,671 | 25 | % | $ | 51,679 | ||||||||

| Kevin T. Thompson | 10 | % | $ | 8,277 | 25 | % | $ | 20,694 | ||||||||

| Gregory P. Allen | 10 | % | $ | 7,601 | 25 | % | $ | 19,002 | ||||||||

| John R. Reisner | 10 | % | $ | 6,962 | 25 | % | $ | 17,404 | ||||||||

| Dennis E. Rose | 10 | % | $ | 4,289 | 25 | % | $ | 10,723 | ||||||||

No additional payout may be granted by the Committee for achievement of this additional performance goal if the Named Executive Officer has achieved the maximum potential payout under such individual’s long-term incentive compensation award based upon the primary performance criteria. The Committee, thus, may not award a payout for achievement of the additional performance goal if such payout would result in an overall payout above the maximum bonus potential. In addition, the Named Executive Officer must achieve the threshold level of performance under the primary performance criteria before being eligible to earn any payout based upon the additional performance goal.

The Committee continued the “kicker” goal as a component under the 2017 long-term incentive compensation awards. The levels established for this goal for the 2017-2019 performance period are described below:

| Award Formula Component | Threshold | Target | Maximum | |||||||||

| Total Assets (in thousands) | $ | 3,300,000 | $ | 3,800,000 | $ | 4,300,000 | ||||||

Achievement of the performance levels are determined by the Committee, in its sole discretion.

For the 2015 long-term incentive compensation awards with a performance period ending on December 31, 2017, the payout percentage of the bonus potential under the additional performance goal, subject to achievement of threshold levels under the primary performance criteria and limited to the maximum bonus potential under the 2015 long-term incentive compensation awards, is described below:

| Award Formula Component | Threshold | Target | Maximum | Actual Attained | Payout Percentage | |||||||||||||||

| Total Assets (in thousands) | $ | 2,700,000 | $ | 3,200,000 | $ | 3,700,000 | $ | 2,993,604 | 14.40 | % | ||||||||||

Clawback Policy

In addition, the Board has adopted an incentive compensation clawback policy providing for a three-year review period of reported results of the Company to ensure that incentive compensation for all executive officers (including the Named Executive Officers) is paid based on accurate financial and operating data and the correct calculation of performance against incentive targets. The policy provisions allow the Company to recover incentive awards previously paid or awarded. A copy of this policy is posted on the Company’s website athttp://www.fdef.com under the link “Governance Documents.”

Retirement Benefits

All of our employees, including the Named Executive Officers, are eligible to participate in the First Defiance Financial Corp. 401(k) Employee Savings Plan (the “Savings Plan”). The Savings Plan is a tax-qualified retirement savings plan pursuant to which all employees are able to contribute up to the limit prescribed by the Internal Revenue Service to the Savings Plan on a before-tax basis. We maintain a safe harbor plan that matches 100% of the first 3% of pay that is contributed to the Savings Plan plus 50% of the salary deferrals between 3% and 5% of compensation. All employee contributions to the Savings Plan are fully vested upon contribution, and our matching contribution is vested upon completion of a minimum service requirement. A restoration plan is maintained for Mr. Hileman and Mr. Thompson which provides for elective deferrals and matching contributions in excess of the Savings Plan caps. The matching contributions under the restoration plan in fiscal year 2017 are included in the All Other Compensation column of the Summary Compensation Table and reported under “Company Deferred Compensation Plan Contribution” in footnote 3 to the Summary Compensation Table.

The Named Executive Officers are entitled to participate in the First Defiance Deferred Compensation Plan, which enables the Named Executive Officers to defer up to 80% of their base salary and up to 100% of bonus payments. The First Defiance Deferred Compensation Plan is discussed in further detail under the heading “Executive Compensation — Nonqualified Deferred Compensation” below.

Perquisites and Other Personal Benefits

We provide our Named Executive Officers with perquisites and other personal benefits that the Committee believes are reasonable and consistent with our overall compensation program to better enable us to attract and retain employees for key positions. The Committee periodically reviews the levels of perquisites and other personal benefits provided to Named Executive Officers.

In 2017, we provided each of the Named Executive Officers, other than Mr. Allen, with the option to receive a $600 monthly automobile allowance, only Mr. Rose exercised the option. We provide Mr. Allen the use of a Company-owned vehicle. Each Named Executive Officer is eligible, upon relocation, to receive reimbursement for certain reasonable expenses associated with the costs of such relocation. The Company considers reimbursement requests for country club and other social organization membership for its senior officers, including the Named Executive Officers, for certain business purposes.

We offer an Executive Group Life Post-Separation Plan, which provides death benefits equal to two times the executive’s base salary. All of the Named Executive Officers participate in the Executive Group Life Post-Separation Plan, except Mr. Thompson and Mr. Reisner.

The value of these perquisites is included in column (g) of the Summary Compensation Table.

Employment and Change in Control Agreements

We have employment or change of control agreements with certain key employees, including the Named Executive Officers. These agreements include provisions for severance payments upon a change of control and are designed to promote stability and continuity of senior management. Information regarding applicable payments under such agreements for the Named Executive Officers is provided under the heading “Executive Compensation — Potential Payments Upon Termination or Change in Control” below.

Section 162(m)

Prior to December 22, 2017, when the Tax Cuts and Jobs Act of 2017 (“TCJA”) was signed into law, Section 162(m) of the Internal Revenue Code generally disallowed a tax deduction to publicly held companies for compensation paid to certain “covered employees” in excess of $1 million per covered employee in any year, except to the extent that the compensation in excess of the limit qualified as performance-based. In connection with fiscal 2017 compensation decisions, the Compensation Committee and the Board of Directors considered the potential tax deductibility of executive compensation under Section 162(m) of the Internal Revenue Code and sought to qualify certain elements of these applicable executives’ compensation as performance-based while also providing amounts and types of compensation that would best fulfill the objectives of the Company’s compensation program.

Under the TCJA, the performance-based exception has been repealed and the $1 million deduction limit now applies to (1) anyone serving as the chief executive officer or the chief financial officer at any time during the taxable year, (2) the top three other highest compensated executive officers serving at the end of the taxable year, and (3) any individual who had been a covered employee for any taxable year of the company that started after December 31, 2016. However, the new rules do not apply to remuneration provided pursuant to a written binding contract in effect on November 2, 2017 that is not modified in any material respect after that date. Because of ambiguities and uncertainties as to the application and interpretation of this transition relief, no assurance can be given that compensation intended to satisfy the requirements for exemption from Section 162(m) will avoid the deduction limit. We believe that the amount of compensation paid to our executive officers that can be deducted will decrease compared to prior years.

The Board of Directors has not adopted a formal policy regarding tax deductibility of compensation paid to our executive officers. The Board of Directors may authorize compensation that might not be deductible, and may modify compensation that was initially intended to be exempt from Section 162(m), if it determines that such compensation decisions are in the best interests of the Company and its shareholders.

COMPENSATION COMMITTEE REPORT

First Defiance’s Compensation Committee has reviewed and discussed the Compensation Discussion and Analysis required by Item 402(b) of Regulation S-K with management and, based on such review and discussions, the Compensation Committee recommended to the Board that the Compensation Discussion and Analysis be included in this Proxy Statement and our annual report on Form 10-K.

Samuel S. Strausbaugh, Chairman

Terri A. Bettinger

John L. Bookmyer

Jean A. Hubbard

February 20, 2018

EXECUTIVE COMPENSATION

Summary Compensation Table

The table below summarizes the total compensation paid or earned by each of the Named Executive Officers for the fiscal years ended December 31, 2017, 2016 and 2015. The Named Executive Officers include those persons serving as our CEO and CFO during 2017 and our three other most highly compensated executive officers.

| (a) | (b) | (c) | (d) | (e) | (f) | (g) | (h) | |||||||||||||||||||

| Name and Principal Position | Year | Salary ($) | Bonus ($) | Stock Awards ($)(1) | Non-Equity Incentive Plan Compen- sation ($)(2) | All Other Compen- sation ($)(3) | Total ($) | |||||||||||||||||||

| Donald P. Hileman | 2017 | $ | 450,000 | - | $ | 279,065 | $ | 221,657 | $ | 30,883 | $ | 981,605 | ||||||||||||||

| President & Chief Executive | 2016 | 430,000 | $ | 465 | 250,527 | 246,047 | 27,168 | 954,207 | ||||||||||||||||||

| Officer of First Defiance | 2015 | 400,000 | - | 213,505 | 238,212 | 19,805 | 871,522 | |||||||||||||||||||

| and First Federal; CEO of | ||||||||||||||||||||||||||

| First Insurance Group of the | ||||||||||||||||||||||||||

| Midwest, Inc. | ||||||||||||||||||||||||||

| Kevin T. Thompson | 2017 | $ | 231,658 | - | $ | 111,745 | $ | 88,751 | $ | 16,690 | $ | 448,843 | ||||||||||||||

| Executive Vice President & | 2016 | 224,911 | $ | 465 | 127,546 | 100,096 | 13,459 | 466,477 | ||||||||||||||||||

| Chief Financial Officer | 2015 | 218,360 | - | 90,659 | 101,142 | 10,516 | 420,6786 | |||||||||||||||||||

| of First Defiance and First | ||||||||||||||||||||||||||

| Federal | ||||||||||||||||||||||||||

| John R. Reisner | 2017 | $ | 194,847 | - | $ | 93,981 | $ | 79,169 | $ | 13,811 | $ | 381,808 | ||||||||||||||

| Executive Vice President | 2016 | 187,353 | $ | 465 | 110,477 | 81,936 | 8,773 | 389,004 | ||||||||||||||||||

| & Chief Risk Officer and | 2015 | 180,147 | - | 74,796 | 83,442 | 10,973 | 349,358 | |||||||||||||||||||

| Legal Counsel of First Defiance | ||||||||||||||||||||||||||

| and First Federal | ||||||||||||||||||||||||||

| Gregory R. Allen | 2017 | $ | 212,695 | - | $ | 102,612 | $ | 60,061 | $ | 27,767 | $ | 403,134 | ||||||||||||||

| Executive Vice President & | 2016 | 206,500 | $ | 465 | 93,812 | 97,408 | 22,389 | 420,574 | ||||||||||||||||||

| Community Banking President | 2015 | 200,000 | - | 83,021 | 92,638 | 22,862 | 398,521 | |||||||||||||||||||

| of First Federal | ||||||||||||||||||||||||||

| Dennis E. Rose | 2017 | $ | 167,988 | - | $ | 57,904 | $ | 50,228 | $ | 14,835 | $ | 290,955 | ||||||||||||||

| Executive Vice President & | 2016 | 163,142 | $ | 465 | 45,978 | 30,001 | 11,030 | 250,616 | ||||||||||||||||||

| Director of Strategy | 2015 | 167,744 | - | 44,959 | 11,621 | 259,918 | ||||||||||||||||||||

| Management | ||||||||||||||||||||||||||

| Name | Club Membership | Automobile Allowance or Personal Use of Company Automobile | 401(k) Match | Value of Insurance | Employee Stock Purchase Plan Match (a) | Company Deferred Compensation Plan Contribution | Total | |||||||||||||||||||||

| Donald P. Hileman | $ | - | $ | - | $ | 10,800 | $ | 3,549 | $ | 390 | $ | 16,144 | $ | 30,883 | ||||||||||||||

| Kevin T. Thompson | $ | - | $ | - | $ | 10,800 | $ | 1,594 | $ | 1,800 | $ | 2,496 | $ | 16,690 | ||||||||||||||

| John R. Reisner | $ | - | $ | - | $ | 10,800 | $ | 1,361 | $ | 1,650 | $ | - | $ | 13,811 | ||||||||||||||

| Gregory R. Allen | $ | 7,449 | $ | 7,052 | $ | 10,800 | $ | 666 | $ | 1,800 | $ | - | $ | 27,767 | ||||||||||||||

| Dennis E. Rose | $ | - | $ | 6,111 | $ | 8,316 | $ | 408 | $ | - | $ | - | $ | 14,835 | ||||||||||||||

2017 Grants of Plan-Based Awards

During 2017, we made awards to Named Executive Officers as part of short-term and long-term incentive compensation under the Incentive Compensation Plan, as described above. The short-term incentive compensation awards provide for cash payments. The long-term incentive compensation awards are made in RSUs and settled in FDEF shares.

| Estimated Future Payouts Under Non- Equity Incentive Plan Awards (1) | Estimated Future Payouts Under Equity Incentive Plan Awards (2) | |||||||||||||||||||||||||||||||

| Name | Grant Date | Date Approved by Compensation Committee | Threshold ($) | Target ($) | Maximum ($) | Threshold (Shares/ Units) | Target (Shares/ Units) | Maximum (Share/ Units) | Grant Date Fair Value of Stock Awards | |||||||||||||||||||||||

| Donald P. Hileman | 01/01/17 | 12/19/2016 | $ | 101,250 | $ | 202,500 | $ | 303,750 | 2,017 | 4,033 | 6,111 | $ | 310,072 | |||||||||||||||||||

| Kevin T. Thompson | 01/01/17 | 12/19/2016 | $ | 40,540 | $ | 81,080 | $ | 121,620 | 808 | 1,615 | 2,447 | $ | 124,161 | |||||||||||||||||||

| John R. Reisner | 01/01/17 | 12/19/2016 | $ | 34,598 | $ | 69,196 | $ | 103,794 | 679 | 1,358 | 2,058 | $ | 104,423 | |||||||||||||||||||

| Gregory R. Allen | 01/01/17 | 12/19/2016 | $ | 37,222 | $ | 74,443 | $ | 111,665 | 742 | 1,483 | 2,247 | $ | 114,013 | |||||||||||||||||||

| Dennis E. Rose | 01/01/17 | 12/19/2016 | $ | 21,093 | $ | 42,186 | $ | 63,629 | 418 | 837 | 1,268 | $ | 64,338 | |||||||||||||||||||

Outstanding Equity Awards at Fiscal Year-End 2017

The following table provides information concerning unexercised options and non-vested stock awards for each Named Executive Officer outstanding as of the end of the most recently completed fiscal year. Each outstanding award is represented by a separate row which indicates the number of securities underlying the award. The table also discloses the exercise price and the expiration date.

| Option Awards | Stock Awards | |||||||||||||||||||||||||||||

| Name | Number of Securities Underlying Unexercised Options(#) Exercisable | Number of Securities Underlying Unexercised Options(#) Unexercisable | Option Exercise Price | Option Expiration Date | Number of shares or units of stock that have not vested (#) | Market (#) | Equity incentive plan awards: number of unearned shares, units or other rights that have not vested (#)(1) | Equity incentive plan awards: market or payout value of unearned shares, units or other rights that have not vested ($) | ||||||||||||||||||||||